Another midterm is coming up, so I decided to do another one of these.

Intro

What is the intersection of business and politics? To answer that question, one must first think about countries, and which countries are “successful.” As it turns out, no matter how success is measured, whether it is healthcare, safety, gender equality, human rights, freedom, access to education, etc., this success is always correlated with a high GDP. Thus, businesses, which drive GDP, are crucial to a country’s success. In turn, a country’s policies are also crucial to business success. Therefore, collaboration between the two is extremely important for positive outcomes.

“The Myth of Asia’s Growth Miracle” (Krugman 1994)

GDP = A * f(K,L)

- A = Efficiency

- K = Capital

- L = Labor

As stated by this function, GDP of a country is equal to efficiency multiplied by a function of capital and labor. Krugman argues that the reason the Soviet Union grew so fast under communism was that the command economy forced people into the labor force and ensured huge investment into capital (by building railroads, infrastructure, etc.). Yet, once all the people were working, and all the infrastructure was built, the soviet union “maxed out” and was unable to continue growing, as it could not increase efficiency under a non-capitalist system.

Krugman then writes about “Asian Tigers” (countries such as China, South Korea, and Singapore) that were seeing phenomenal and unprecedented growth. His argument was that these countries were unlikely to overcome the US in GDP because of the way that these Asian Tigers were driving growth: expanding capital by building factories and infrastructure, and expanding the labor force through urbanization, longer work hours, higher education access, and allowing women to work. This explains why these countries initially had huge rates of growth: yet, raising efficiency is much more difficult, and so once capital and labor have been “maxed out,” you’ll see the growth of Asian Tigers slow down significantly. Case in point for Krugman was Japan: a country that was predicted to overtake the US in GDP in the late 1900’s, but never did.

Limitations: Krugman’s formula doesn’t include natural resources or land, both of which are things that are extremely important in determining a country’s growth. An example of this is colonization- something that allowed smaller countries to grow and expand despite their limited size. Also, as Krugman himself points out, China is so large that it could outpace the US’s GDP at a low level of efficiency.

The future of growth – (McKinsey 2015)

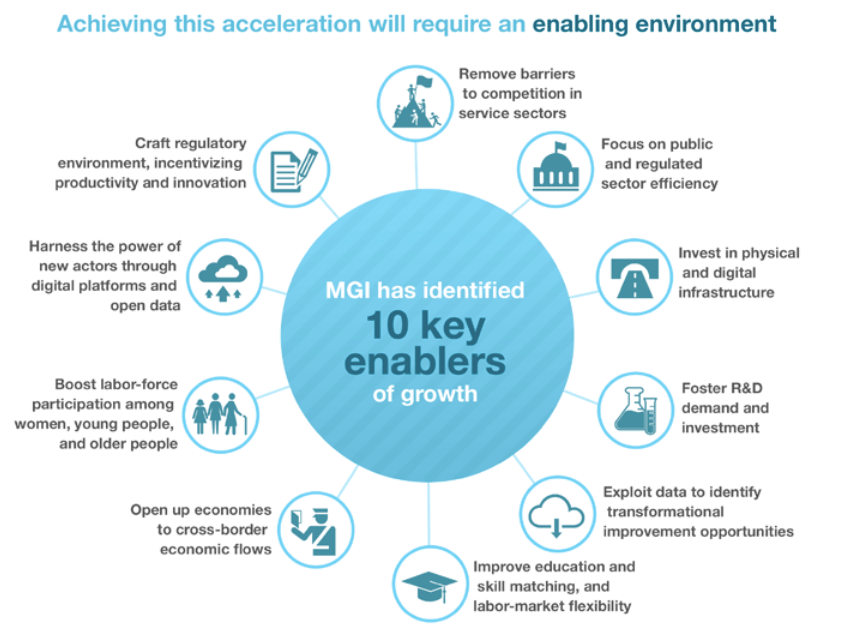

Population growth, at least in developed countries, has slowed to a halt. Thus, increasing efficiency is the only way to create GDP growth similar to that of the past. So, how is efficiency enabled? According to McKinsey, it is primarily through government policy:

Argentina Case

Argentina and the US were economic rivals in the 1900’s. Nowadays, Argentina’s economy is broken while the US’s economy leads the world. What happened?

US

- New land given to settlers

- Skilled immigration

- Embraced industrial revolution

- (relatively) open trade

Argentina

- New land divided among rich

- Low-skilled immigration

- Protected “old wealth” by rejecting progress

- Closed economy

Applying the framework from Krugman, one can see that the US had policies that resulted in a high level of efficiency, while Argentina’s policies discouraged risk and protected dying, inefficient industries. Additionally, the US’s policy of giving new land to settlers encouraged immigration (specifically high-skilled immigration), resulting in high increases in the labor force. Argentina’s policy of dividing the land among the rich, on the other hand, resulted in the immigration of only low-skilled laborers who would work for these wealthy landowners. Argentina’s situation would only worsen when a dictator came to power and instituted high tariffs to protect struggling and uncompetitive industries. Social instability and undisciplined borrowing had additional negative consequences on Argentina’s economy.

US-China Trade

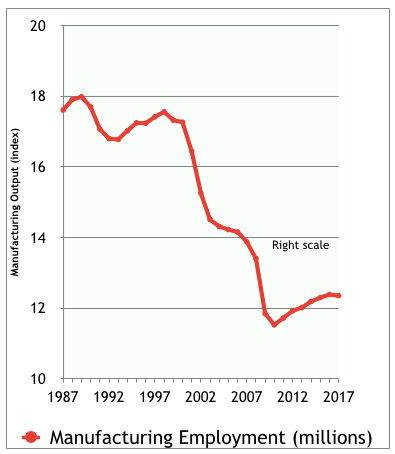

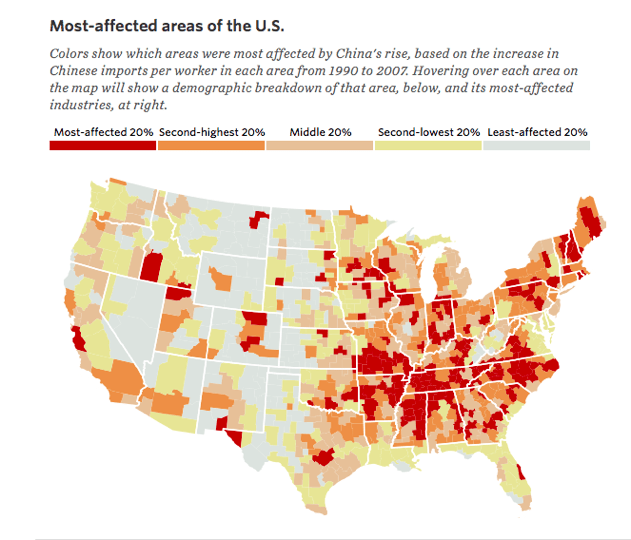

Economists often argue that free trade results in highly efficient markets, and so based on Krugman’s article, one would expect countries to adopt free trade policies across the board. The US-China trade war shows that this is not the case. Countries (particularly governments) also have to consider things such as protecting infantile industries and getting re-elected.

Clinton’s perspective: Bill Clinton told China early on that a condition for establishing permanent normal trade relations (PNTR) would be an increase in human rights. Under immense pressure from businesses, Clinton eventually walked back these claims, and signed PNTR close to the end of his presidency.

US Business perspective: US businesses have complained about low IP protections, censorship, and protectionist policies making it hard for them to compete in China’s market. Despite this, businesses on the whole are in favor of free trade with China. This is because China is such a large and important market that businesses have no choice but to play with China’s rules if they want to do business there. The “China Lobby,” consisting of US companies in favor of free trade with China, is one of the strongest lobbying forces in the US.

Trump’s perspective: Trump’s key constituency was disproportionately affected by trade with China (average: white, 50yrs, male, high school diploma). Thus, his tough stance on China appeals to his constituency, and will likely help him get re-elected.

China’s perspective: China has refused to give in to Trump’s trade demands. China has a long history of distrusting foreign companies and countries, especially after the British forced trade agreements upon China through the Opium Wars and the colonization of Hong Kong. Not wanting to be forced to accept the demands of a foreign power ever again, China has focused a lot of efforts into self-sufficiency and uniting the nation.

India

India is similar to China in many ways, with one of the major differences being that it has embraced a much more democratic system. As recently as 2014, India has been inviting foreign companies into the country as a way of generating economic activity through an increase in capital. This prompted companies like Amazon to invest large amounts of resources into the market. Fast forward to 2020, and India’s commerce minister, Piyush Goyal, said of Amazon’s announcement to invest $1 billion to help small businesses in the country, “It is not as if they are doing a favor to India,” a statement reflective of a sudden shift in tone compared to India’s previously open arms. (Source)

“It is not as if they are doing a favor to India.”

Piyush Goyal, Commerce Minister

India has seen the success of infant companies in China that were able to grow due to protectionist policies, such as how banning Facebook helped WeChat. Thus, India is a lot more willing to work against gigantic firms like Amazon. Additionally, India knows that it has a lot more power now that Amazon has already decided to commit a large amount of resources into its India operation- and Amazon certainly does not want to lose access to one of the largest markets in the world. This is also known as time inconsistency– the idea that promises made today can’t be enforced tomorrow.

Collision Course or Virtuous Cycle? (Garret 1998)

A common talking point in American politics today is that imposing high taxes on companies will cause them to move abroad. Thus, it makes sense to lower tax rates in order to incentivize companies to stay in the US. Applying this logic to its rational conclusion, one might argue that taxes are a “race to the bottom,” and that taxes will eventually reach 0% as countries compete with each-other over businesses.

Garret explains that globalization is not, in fact, a “race to the bottom,” and that states have a lot more power than simply having to obey the whims of a few corporations. Thus, states can (and should) pursue globalization without impacting their freedom to make policy choices. There are a lot of reasons that a company would not simply go to the country with the lowest tax rate, namely that:

- States with taxes have accumulation of human + physical capital

- The good of government programs often outweighs the costs by creating social stability

Globalization results in increased global efficiency by reducing costs and encouraging specialization. Yet, states have historically increased tariffs and protectionist policies out of a fear that open trade policies will hurt workers and businesses. Garret offers a solution to countries who are struggling between making the calculus between protecting its own domestic interests with pursuing free trade: to use the economic growth gained from free trade to pay for domestic compensation programs. The Keynesian wellfare state supplies goods that are undersupplied by markets, such as securing property rights and upholding the law. Yet, Garret seems to be suggesting that the government could expand the wellfare state far beyond this point and still be competitive, because businesses will choose to stay in a country that has a large amount of stability and human/physical capital.

Application: Garret would criticize the trade war with China, and argue that if Trump were worried about the workers who lost their jobs to manufacturing, he could instead allocate money towards those communities towards wellfare programs for the workers that lost their jobs. Instead, the trade war comes at significant costs in terms of economic growth and efficiency, and those costs could have simply paid for a strong wellfare program.

Limitations: Garret assumes that the wellfare state would cost less than the economic efficiency gained from globalization, but this might not be the case, especially given common issues with wellfare (such as the “freeloader” issue, fraud, innate government inefficiency, and the fact that wellfare is difficult to remove once it is enacted). Garret also doesn’t appear to acknowledge the apparent success of the Chinese model of protecting infant industries. One might ask if you would really have the middle school soccer team (infant industries) compete against national champions (well-established titan companies from another country). Perhaps allowing small companies to grow by protecting them from having to compete with much larger companies will allow them to eventually compete on their own.

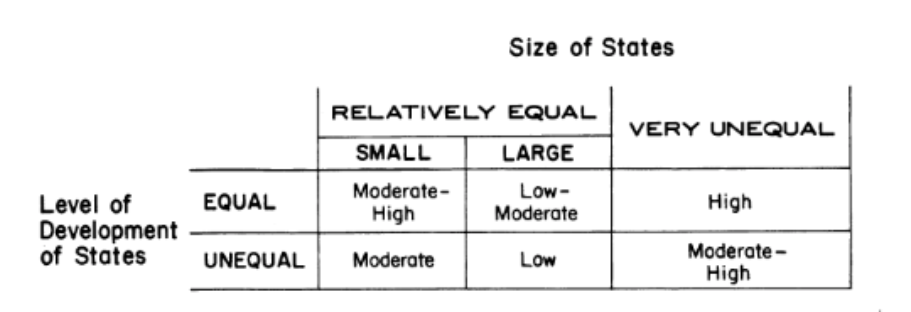

State Power + Structure of International Trade (Krasner 1976)

It seems like states are reluctant to change their policies, even ones that seem to be obviously beneficial (such as free trade). Krasner, however, is much more concerned about the long term than Garret is. He argues that large developed states are liable to lose their long-term technological advantage under a system of open trade unless they can continue developing new technologies to remain at the forefront. Additionally, open trade can create social instability because international price changes will destroy certain industries. This has a larger impact on a less developed state because workers are less likely to be skilled, and thus it is harder for them to move industries. Thus, unequal development among countries often results in a closed trade system.

Additionally, smaller states tend to gain more out of open trade because unlike larger states, it is hard for small states to be entirely self-sufficient. Thus, smaller states tend to want open trade more than larger states. Interestingly, the case that most likely results in open trade is the case of one hegemonic/dominant power in its ascendency. A large, hegemonic power in its ascendency is not worried about falling behind as it is so much farther ahead than other countries, and will be for the foreseeable future. Additionally, other countries that are much smaller than it all want to trade with this large power for access to their market and the potential for rapid growth. While less developed countries may still be worried about the socially destabilizing effects of international price changes, they are less so because a hegemonic power often results in periods of relative economic stability. Additionally, a hegemonic power can often coerce less-developed powers into collaboration through force or economic threats. Krasner’s key realization is that the long term plays a huge role in the decision calculus of a country trying to decide whether it should be open or not, and that an open system is achieved only when both/all parties are willing (barring the use of force). This helps explains why Garret’s world- in which free trade is the obvious choice – is often not the reality.

This explains why markets were relatively open from 1820-1879 (British ascendency), closed from 1880-1900 (waning of British power), and very open from 1945-1970 (US dominance). There are two notable exceptions: from 1900-1913 there was a period of openness due to a large number of loans right before WW1. Additionally, from 1918-1939 markets remained very closed, despite the fact that the US was quickly achieving the status of the dominant world power. This is because the US government was historically quite isolationist- until it was forced not to be by WW2. Krasner thus reveals one final impediment to openness: governments require an outside force to change prior policies. One might remember the first law of motion from physics class, “An object at rest tends to stay at rest.” The US historically had isolationist policies, and so even as it was approaching hegemonic levels of power, it still took a massive event to change its approach to policy.

Application: One could apply Krasner in analyzing why markets seem to be becoming more closed. The US is much more concerned about maintaining its long term lead than it was before- and so the US has begun adopting protectionist policies to maintain its technological edge (you can actually see this in the Trump administration’s approach to China, in which one of the main arguments for the trade war with China is the issue of IP theft).

Limitations: Krasner vastly simplifies countries into buckets of size and development. Yet, one could think of many other ways in which countries differ. A small and less developed country with a lot of natural resources (say, an oil-rich country like Saudi Arabia) is more self-sufficient than the model would suggest, and more willing to weather the risks of trade with more developed countries. Krasner also seems to ignore the impacts of influential and wealthy actors in distorting state incentives. A few influential interests can swing a country’s decision of pursuing policies of openness.

How far will International Economic Integration go? (Rodrik 2000)

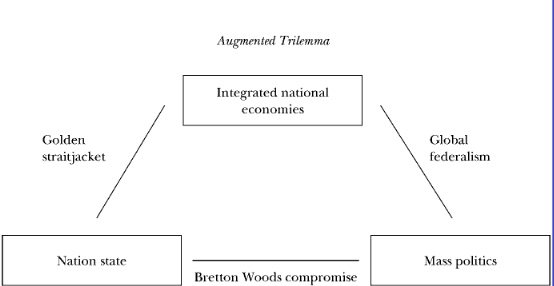

Rodrik takes Krasner’s argument of believing that a strong, hegemonic power often results in openness, and runs it to its logical end. He believes that full international economic integration requires a Global Federation. A Global Federation would be like the European Union on steroids- with a world power able to determine economic policies for the entire world.

Rodrik seems to take the classical reasoning of why markets often remain closed- a race to the bottom where countries lose political power by being forced to adopt policies such as low tax rates, small government, and de-regulation (Garret would argue that this is actually not true). While countries can participate in this “race to the bottom” to create open markets, they may not be willing to give up political power to do so. He terms this the “golden straitjacket,” because while it brings in economic activity, it is severely limiting politically.

Finally, Rodrik seems to address an argument of using GATT (he terms it the Bretton Woods compromise) – the general agreement on tariffs and trade – to create international economic integration. GATT is basically a way to prevent a “race to the bottom” by creating a giant gentleman’s agreement among countries to not compete with each-other on domestic policy to attract trade. Yet, questions of enforcement make GATT an unrealistic solution. It would only fully work if countries were willing to “play by the rules,” but in practice countries aren’t so willing to sacrifice their own industries to achieve economic integration.

This leaves the solution of a global federation that has enough power to actually enforce something like GATT by creating international policy.

Applications: Rodrik’s theories can be applied in a very similar way to Krasner’s theory in explaining why full international economic integration has not really occurred. The closest thing to something like a Global Federation is probably the European Union, and one can point to a lot of ways in which the EU created economic integration, such as by standardizing the Euro.

Limitations: It is very hard to imagine the decline of the Nation-State. Even the future of the European Union is doubtful with the recent advent of Brexit. Thus, even if Rodrik is right about the benefits of a Global Federation, it might be no more than a utopian dream.

Value Maximization, Stakeholder Theory, and the Corporate Objective Function (Jensen 2000)

With this article, the class shifts towards an analysis of companies. There are two main theories of business that Jensen deals with.

- Companies are only concerned with profit.

- Companies should serve their stakeholders (their employees, consumers, managers, etc.) by being concerned about productivity, efficiency, social welfare, accountability, and many other things.

There are a few issues with the first theory of business, the main one being that it is uninspiring to both consumers and workers. Thus, you’ll almost never see a company (at least, not publicly) proclaim their mission statement to be “our mission is to make money.” The main issue with the second mode of thought is that it is really hard to balance all of the stakeholders in a company fairly. In practice, it just allows the CEO to do whatever they want, because pretty much any decision can be justified as being good for a stakeholder.

Thus, Jensen argues that companies should consider the interests of their stakeholders, but do so in a way that maximizes profits in the long term. While this seems like having your cake and eating it too, Jensen argues that a pure focus on profits is actually bad in the long term because nobody wants to work for/do business with a company with that mentality. By caring about what workers, consumers, and other stakeholders want, a company can still pursue policies that are good for the bottom line, but demonstrate to stakeholders that their concern is not simply about how much money the company is worth.

Application: Boeing is a good example of a company that was punished for only being concerned about profit. By ignoring key stakeholders in the company, such as engineers who brought up concerns over how Boeing took shortcuts to fast-forward approval for new planes, Boeing caused several airplanes to crash. This tarnished their reputation, and may have caused irreversible damage to the company in the long term. By listening to their engineers or creating training programs for pilots, Boeing might not have actually sacrificed that much money, and they wouldn’t be in the crisis that they are in right now.

Limitations: Unfortunately, managers seem to have little (if any) incentive to care about the long term. Often times, a manager is compensated based on the short-term stock price. This distorts the incentives for the CEO, making them a lot less likely to care about stakeholders other than investors. This was actually the case with Boeing. The same managers that ignored engineers and pilots were actually given large raises by “beating estimates.”

The Political Economy of the Foreign Corrupt Practices Act (Perlman and Sykes 2018)

The Foreign Corrupt Practices Act (FCPA) imposes significant penalties on US Companies if they are found to be bribing government officials in foreign countries. At first glance, it seems like this would be extremely bad for US competitiveness. After all, if companies cannot bribe foreign officials, then how will they manage to secure contracts overseas?

Fascinatingly, the opposite occurred, and the Foreign Corrupt Practices Act helped US companies be more competitive in the long run. This is because foreign officials, knowing the extreme power they held over foreign companies, could easily blackmail a company in exchange for continued cooperation. Additionally, corrupt foreign officials would often create competition among companies to bid for certain contracts. Thus, while a company might be able to secure a great opportunity in the short run, in the long run they would be bled dry by corrupt officials.

By making it clear from the start that they cannot engage in corruption, US companies gained a huge amount of leverage in negotiations with foreign officials. When asked for a bribe, a US company could simply point to the FCPA as a reason for not being able to pay it. While it is true that this undoubtably led to the loss of some business contracts, it is unlikely that those business contracts would have been worthwhile pursuing in the long run anyway.

Applications: What makes this situation interesting is the fact that by having less options, companies were more competitive. This is actually seen again later in the course when discussing voting. If too many similar candidates run against each-other, it can split support and cause an unpopular candidate to win. Lessons from the FCPA can also be applied to other situations, such as mutually assured destruction (MAD). By guaranteeing global nuclear warfare if even one nuke is launched, the use of nuclear weapons is prevented.

Limitations: The FCPA likely hurt companies that did not need to sink large amounts of capital into foreign countries, as these companies would likely not be extorted for bribes anyway. Additionally, companies that only have to deal with foreign officials for a short period of time could also be disadvantaged. Finally, small companies might have trouble complying with FCPA regulations that force them to submit detailed documentation and pay significant fees. Additionally, competition for contracts in foreign countries is often among 2 or more US firms anyway, which may help explain why many other countries have not enacted similar policies.

The Nature of Belief Systems in Mass Publics (Converse 1964)

Converse examined how people made their political views through a series of studies on American voters.

- Group Interests – 45% (of voters)

- Nature of the Times – 22%

- No Issue Content – 17.5%

- Near-Ideologues – 12%

- Ideologues – 3.5%

Converse defines “Group Interests” as people who vote based on which group they think a politician represents. They differ from ideologues and near-ideologues because they only have a surface-level understanding of what a politician stands for. By contrast, ideologues are able to articulate a clear reasoning for their vote, while near-ideologues seem to have some conceptual understanding, but it is either incomplete or not fully thought-out. Those who vote based on the “nature of the times” evaluate candidates based on whether the economy was doing well, or some other factor. Finally, “No Issue Content” voters had next to zero understanding of why they were voting for a particular candidate.

Converse uses this result to show that the American public, on average, has low “constraint.” Constraint refers to the consistency of beliefs. An example would be someone who believes in small government- someone with this belief would have high constraint on issues such as whether the government should increase taxes. On the other hand, American “elites” generally have high constraint. Thus, political elites play a huge role in whether the public sees two issues as related or not. It also means that the opinions of the public are highly unstable.

Applications: Converse helps explain a lot of phenomenon in politics, such as incumbent advantage and how the state of the economy plays a huge role in dictating whether the presiding government is popular (regardless of whether the presiding government is actually responsible for the economic situation). After all, the 22% of voters who vote based on the “nature of the times” has a huge impact in deciding elections. Because only a small percentage of people have high constraint, ads, endorsements, and other factors that seem tangentially related to a politician’s actual quality or stances are actually very important in deciding an election.

Limitations: The US has become a lot more educated, and so it is possible that the population is much more deeply engaged in politics than they were in 1964. Also, Converse’s method does not account for the possible underlying psychological reasons that many people vote the way they do. For example, a significant number of people vote solely on the political party affiliation of their parents (potentially without thinking or knowing about it), and would be unlikely to list that as a reason in an interview.

Inequality and Democratic Responsiveness (Gilens 2005)

Gilens’s research shows that wealthier people have a larger impact on political outcomes than poorer people. Gilens reached this conclusion after the results of surveys over a period of 21 years that asked respondents whether they opposed or supported a particular policy, and compared this with the actual outcome of a policy.

Interestingly, Gillens found other correlations that could override this correlation. Firstly, there was a large bias for maintaining the status quo. Secondly, unpopular policies were unlikely to be adopted, even if they were supported by wealthy individuals. It is a popular policy that the rich/wealthy oppose that is unlikely to be adopted. That being said, the effect of wealthier individuals is often vastly underestimated because wealthy and poor people often agree on many policies.

Gilens goes on to point out that this is likely not a malicious outcome, but simply a reflection of the fact that wealthier individuals have more resources to lobby and donate to politicians. On the other hand, there isn’t really a mechanism that allows the poor to effectively influence politicians outside of elections (which, as will be covered later, is a poor tool for keeping politicians accountable).

Applications: Gilens’s research is important in understanding why states pursue policies that are not always reflective of what the general public wants. Perhaps it can partially explain how seemingly popular policies, such as increased legislation and oversight over tech companies due to privacy concerns, can be overridden by the preferences of the wealthy (many of whom presumably attained their wealth through tech).

Limitations: Gilen’s research doesn’t account for the fact that the opinions of poorer people can be affected by the opinions of those who are wealthier and more influential. Thus, even if it seems like wealthy and poorer people agree on a particular policy, it could actually be the result of advertising campaigns or the spread of misinformation.

Structural Dependence of the State on Capital (Przeworski and Wallerstein 1988)

Going back to GDP = A * f(K,L), Przeworski and Wallerstein propose that maximizing capital requires minimizing income tax, as companies will choose to reduce investment in order to pay for rising income taxes (in this model, income must be used for investment or consumption. It cannot be hoarded). Yet, a country must collect taxes somehow. Thus, they advocate for a consumption tax, which will divert resources from consumption and towards investment.

Applications: A state looking to maximize capital might want to penalize consumption and reward investment by instituting high consumption taxes and low income taxes.

Limitations: An income tax is extremely easy to implement, which is what makes it a popular tool for the state in increasing the state’s income. Additionally, it ignores the fact that a company (or individual) could simply move to a different state where consumption is cheaper.

I didn’t quite get to every author, but this covers the vast majority of the course (notably missing are discussions on institutions [like voting] and further discussion on voters). I may be updating this page later on to fill in those parts later. Thanks for reading!